Upon saving up a significant portion of your income for the purpose of a deposit, the time has come to prepare for obtaining a mortgage.

In order to guide you effectively, we’ve assembled a comprehensive set of practical and beneficial mortgage advice in Doncaster. These insights are tailored to ensure that you are well-prepared to embark on the mortgage application process with confidence and clarity.

Up-to-Date Credit Report

The initial step to prioritise on your to-do list is obtaining an updated credit report. This action holds importance even before reaching out to a dedicated mortgage broker in Doncaster, such as our team, for mortgage advice. A current credit report streamlines the process for you, enhancing efficiency.

Addressing any outstanding payments on your balance is a prudent move, even if you’re withholding payment due to a dispute with the provider. It’s worth noting that avoiding payment, especially for bills like phone bills, is not advisable.

Clearing such outstanding balances works in your favour, potentially increasing your chances of securing a mortgage. Another beneficial strategy is ensuring your presence on the voters roll, as it positively influences your credit score. Moreover, closing any dormant credit cards can be advantageous.

During the initial stages of your mortgage journey, your dedicated mortgage advisor in Doncaster will meticulously assess your credit report.

Their expertise will provide valuable insights on actions you can take to present your credit history in the best possible light, bolstering your mortgage application process.

Proof of Identification

As you embark on the initial steps of your home buying journey, you’ll be requested to provide photo identification. Typically, our customers find it convenient to submit either a driving license or passport for this purpose.

Interestingly, your driving license can serve a dual role by also verifying your address. It’s important to note that if you use it as proof of address, it cannot be used concurrently as proof of identification. Separate documents are required for each purpose, not a single document for both.

For individuals who aren’t UK nationals but are currently residing within the country, presenting a copy of their Visa is an additional requirement. This step complements the standard photo ID and contributes to a comprehensive verification process.

Proof of Address

In addition to confirming your identity, you’ll also be required to provide documents that establish your current residence. Typically, customers prefer using a recent utility bill or an original bank statement dated within the last three months for this purpose.

Alternatively, as previously mentioned, if you opt for a passport as your photo ID, you can utilise your driving license as a valid proof of address in conjunction with it. This flexibility offers you options for meeting the address verification requirement.

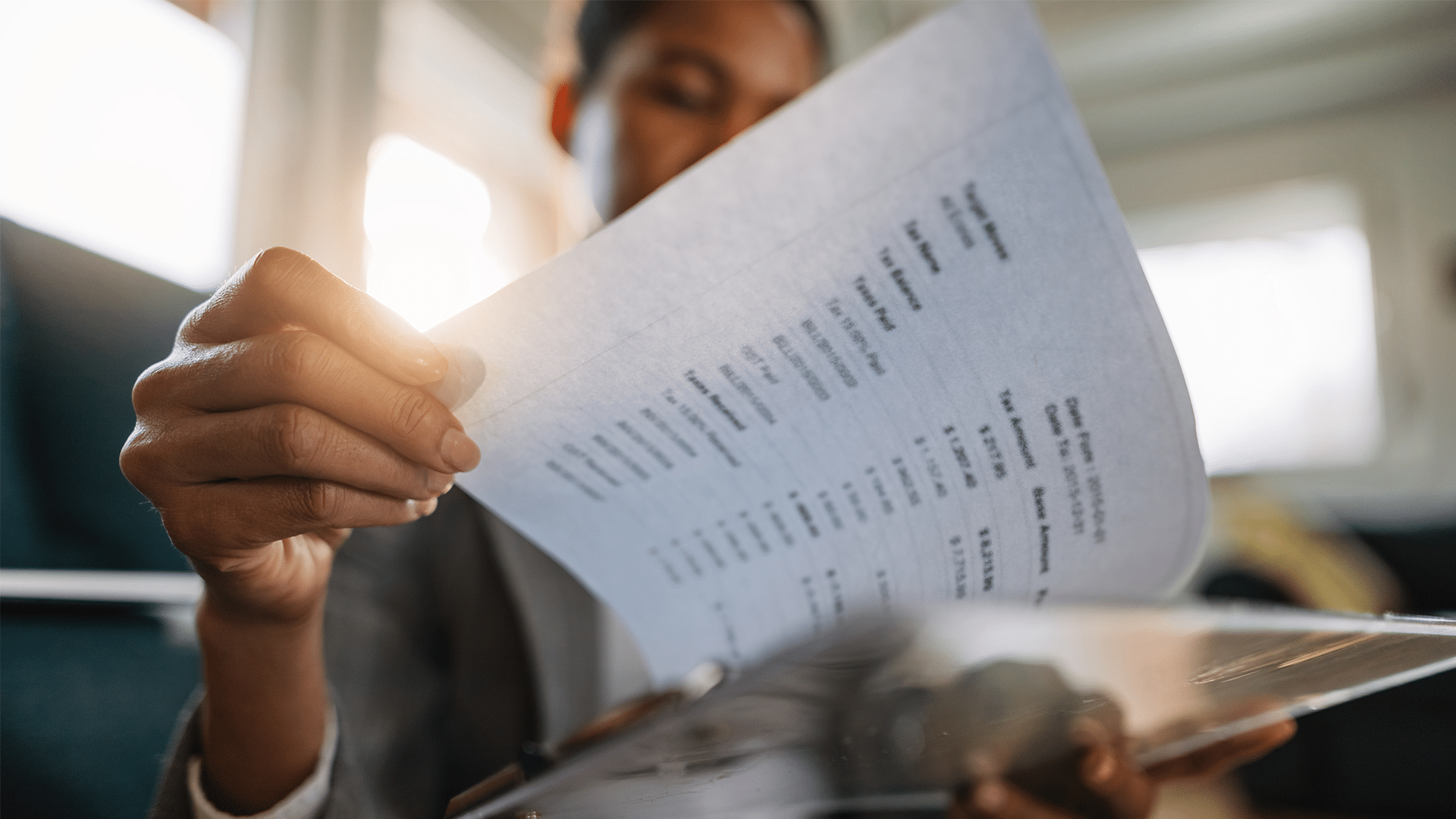

Last 3 Months’ Bank Statements

Your bank statements play a crucial role in demonstrating your income and spending patterns. It’s important to note that if you engage in frequent gambling, it’s advisable to refrain from such activities well in advance. Lenders typically view gambling activities unfavourably when reviewing bank statements.

Similarly, exceeding overdraft limits or having direct debits bounce can also negatively impact your mortgage application. Being well-prepared in these aspects is essential to present yourself favourably to potential mortgage lenders.

Most lenders will carefully review your bank statements as part of their assessment process. This scrutiny helps them gain confidence in your financial responsibility and commitment.

The bank statements required usually showcase your income deposits and outgoing bills, providing lenders with a clear picture of your financial transactions. These documents are pivotal in portraying your financial stability to potential lenders.

Evidence of Deposit

You’ll need to provide evidence of the funds you intend to use for your deposit, which is crucial for complying with anti-money laundering regulations.

To simplify the process, it’s recommended to minimise transferring money across multiple accounts, as this can complicate the audit trail.

Lenders typically prefer to see a gradual accumulation of savings over time. Therefore, if you’ve recently received significant transfers into your accounts, you should be prepared to explain and document their source.

In recent times, it’s become common for property deposits to be gifted by family members. This is particularly popular among first time buyers in Doncaster who are entering the property market.

Gifted deposits also require documentation. The individual providing the gift will need to sign a letter confirming that the money is a gift, not a loan expected to be repaid in the future. This documentation is essential to demonstrate the nature of the transaction to lenders.

Proof of Income

The key factor in determining affordability is providing evidence of your income. Typically, this involves your most recent 3 months of payslips if you’re employed. Some lenders might also require your latest P60 form.

Lenders take into account various sources of income, including regular overtime, shift allowances, bonuses, and commissions. If you have multiple employers or income streams, such as a part-time job or being self employed in Doncaster, these earnings can also be considered.

In today’s landscape, many applicants are self-employed and seeking efficient and approachable mortgage advice in Doncaster. Self employed individuals will need assistance from their accountants to obtain their proof of earnings for the last 2-3 years from the Revenue.

If you manage your own accounts, our mortgage advisors in Doncaster can guide you through the process of downloading the necessary information from the Government Gateway.

Budget Planner

Planning ahead and conducting thorough research is a wise approach. It’s a good idea to create an estimate of your expected expenses once you’ve moved into your new home.

This estimate should encompass factors like projected council tax and utility bills, as well as regular expenditures like groceries and dining expenses.

This planning not only provides insight into your upcoming financial commitments but also helps you gauge the disposable income you’ll have available to cover your mortgage payments.

To help you in this process, we’ll provide you with our version of a budget planner before your mortgage appointment, which we hope you’ll find useful in organising your finances.

Getting Prepared For a Mortgage

As evident from the points highlighted in this article, preparing for a mortgage isn’t an effortless task. With proper planning and cautious steps, the process can become significantly smoother.

Dedication, diligence, and a patient approach will undoubtedly prove valuable as you navigate through your mortgage journey.

Date Last Edited: December 6, 2023